Protecting your home from unexpected risks like fire, flood, burglary, or natural disasters is more important than ever. In India, reconstruction costs can easily exceed ₹3,000-7,000 per sq ft in urban areas, and replacing valuables adds significant expense. Getting home insurance quotes online is the easiest way to find home insurance online that offers comprehensive coverage at affordable premiums—often starting as low as ₹300-600 per year.

In 2025, digital platforms make comparing and buying home insurance seamless, with instant quotes, exclusive discounts, and paperless processes. This guide explains how to get home insurance quotes online, compare options effectively, and secure the best affordable coverage for your property today.

(Suggested Featured Image: House model with security shield, depicting home insurance protection against theft and damage risks.)

Why Get Home Insurance Quotes Online in 2025?

Traditional methods involve agents, paperwork, and limited choices. Switching to home insurance online offers:

- Instant Access: Personalized home insurance quotes in seconds.

- Easy Comparison: Evaluate 15+ insurers on one platform.

- Cost Savings: Online-exclusive discounts (up to 15-20%).

- Transparency: No hidden charges; full policy details upfront.

- Convenience: Buy anytime, anywhere.

Platforms like Policybazaar, insurer sites (HDFC ERGO, Bajaj Allianz, ICICI Lombard), and apps ensure quick, hassle-free experiences. Long-term policies add escalation benefits for rising costs.

(Image: Person researching home insurance quotes on a laptop, illustrating digital convenience.)

Step-by-Step: How to Get Home Insurance Quotes Online

- Assess Your Needs: Decide on structure coverage, contents, or both. Estimate sum insured accurately.

- Choose a Platform: Aggregators like Policybazaar or direct insurer portals.

- Enter Details: Property type, location, area, construction details, contents value.

- Receive Quotes: Instant home insurance quotes from multiple providers.

- Compare Thoroughly: Look at premium, coverage, add-ons, exclusions, and claim settlement ratio (CSR >90%).

- Customize: Add riders like valuables or terrorism cover.

- Review & Buy: Check policy wordings, pay online, and get instant e-policy.

It takes just 10-20 minutes to get multiple quotes!

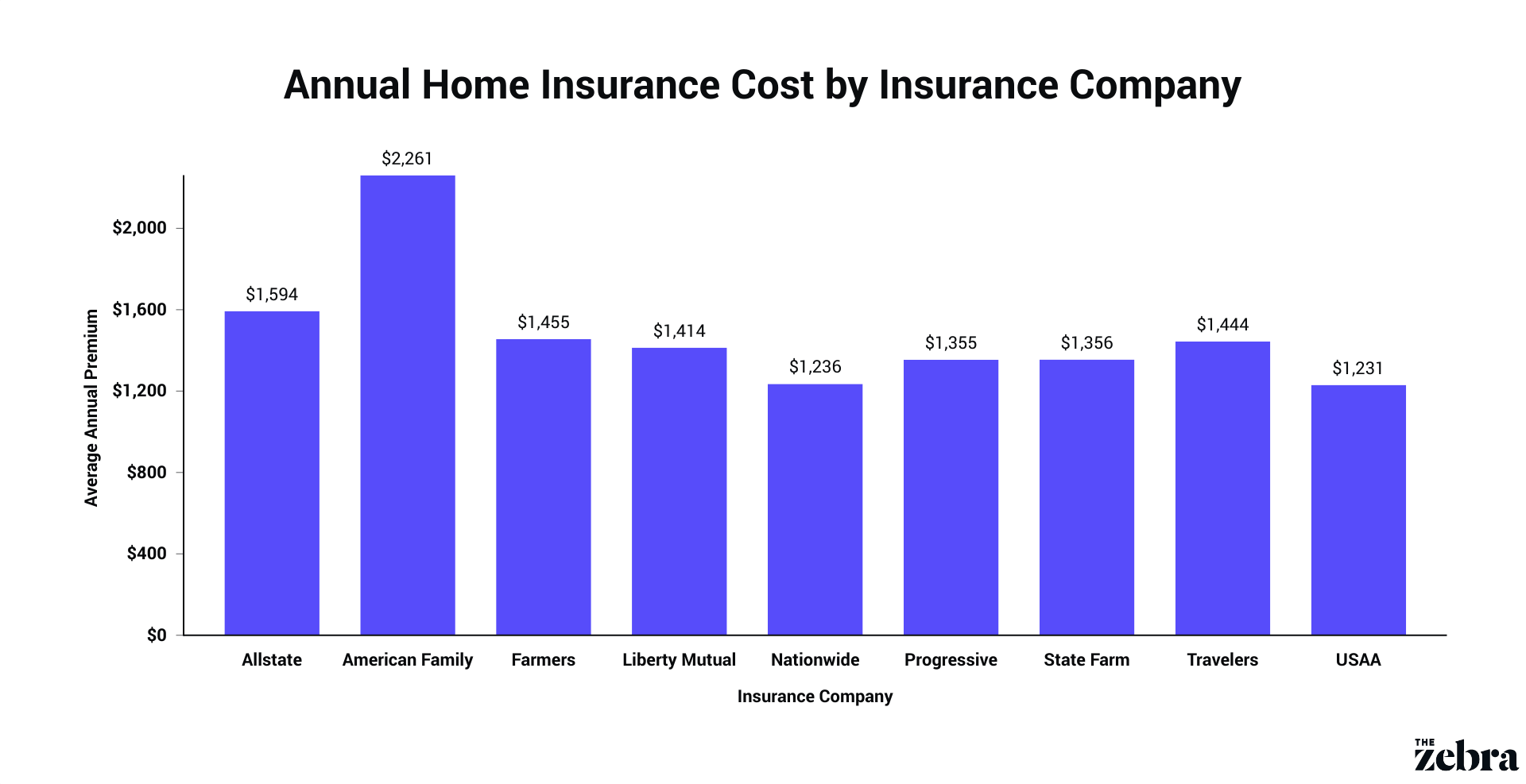

(Image: Home insurance premium comparison chart, showing average costs by company.)

Key Factors to Compare in Home Insurance Quotes

Focus on these for affordable coverage:

- Sum Insured: Based on reconstruction cost (not market value).

- Coverage Scope: Fire, natural calamities, burglary, etc.

- Add-Ons: Jewelry, rent loss, personal accident.

- Deductibles: Higher voluntary deductible lowers premium.

- No-Claim Discount: Up to 50% on renewals.

- Claim Process: Quick settlement and support.

IRDAI's Bharat Griha Raksha provides standard baseline, while premium plans offer enhanced features.

(Image: Damaged home highlighting the need for insurance against floods or fires.)

Top Home Insurance Plans Worth Quoting in 2025

Popular options for reliable coverage:

- HDFC ERGO Home Shield: Comprehensive; valuables add-on; excellent CSR.

- Bajaj Allianz My Home Insurance: Flexible; portable equipment; terrorism optional.

- ICICI Lombard Home Insurance: Rent loss; Bharat Griha Raksha compliant.

- SBI General Long Term: Multi-year discounts; escalation clause.

- IFFCO Tokio Home Protector: Wide perils; fast claims.

Get home insurance quotes online to see tailored premiums.

(Image: Happy family forming a protective roof with hands, symbolizing secure home insurance.)

Tips for Affordable Home Insurance Coverage

Lower your premiums with these strategies:

- Long-Term Policy: 5-10 years for big discounts.

- Security Installations: Alarms/CCTV for 15-25% off.

- Higher Deductible: Reduce premium significantly.

- Bundle Policies: With car/health for savings.

- No-Claim Bonus: Build for cumulative discounts.

- Accurate Details: Avoid under-insurance penalties.

- Online Quotes: Often cheaper than offline.

- Escalation Benefit: Covers inflation.

Common Mistakes When Getting Quotes Online

- Under-insuring to get lower quotes (leads to partial claims).

- Ignoring add-ons for high-value items.

- Not checking exclusions (wear/tear, war).

- Skipping CSR and network support.

- Delaying purchase.

Always read the Customer Information Sheet with your quote.

Conclusion: Secure Affordable Coverage Now

Fetching home insurance quotes online is free, fast, and empowers you to find the best home insurance online for your needs. With rising risks and easy digital access in 2025, affordable comprehensive coverage is just a few clicks away.

Don't leave your home vulnerable—get quotes today and protect your biggest asset with peace of mind!

0 $type={blogger}:

Post a Comment