In India, where financial responsibilities like home loans, children's education, and family support are significant, choosing the right life insurance is crucial. Term life insurance offers pure protection at affordable rates, while whole life insurance provides lifelong coverage with a savings component. The debate often centers on cost versus long-term benefits.

As of December 2025, individual life insurance premiums are fully exempt from 18% GST (effective September 22, 2025), making both types more affordable. This guide compares term life insurance and whole life insurance to help you decide which suits your needs.

(Suggested Featured Image: Indian family protected under a life insurance shield, symbolizing security.)

Understanding Term Life Insurance

Term life insurance is a pure protection plan that covers you for a specific period (e.g., 20-40 years or up to age 70-80).

Key features:

- High sum assured (₹1-2 crore+) at low premiums.

- Payout only on death during the term.

- No maturity benefit if you survive.

- Optional return of premium (ROP) variants.

Ideal for young families needing maximum coverage affordably. With 0% GST, a ₹1 crore term plan can cost ₹500-1,000/month for a 30-year-old non-smoker.

(Image: Happy Indian family enjoying financial security through life insurance.)

Understanding Whole Life Insurance

Whole life insurance covers you for your entire life (up to age 99-100).

Key features:

- Death benefit guaranteed whenever it occurs.

- Builds cash value/savings over time (participating plans add bonuses).

- Higher premiums due to lifelong coverage and investment component.

- Maturity/surrender options available.

Suited for legacy planning or lifelong dependents. Premiums are 5-10x higher than term for similar initial cover.

(Image: Piggy bank illustrating savings growth in whole life policies.)

Key Differences: Term Life vs Whole Life Insurance

| Aspect | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (e.g., 10-40 years) | Entire life (up to 99-100 years) |

| Premium Cost | Low (affordable high cover) | High (5-10x more) |

| Death Benefit | Paid if death during term | Paid whenever death occurs |

| Maturity Benefit | None (or ROP in variants) | Yes (cash value + bonuses) |

| Savings/Investment | No | Yes (grows over time) |

| Best For | Young families, income replacement | Legacy planning, lifelong dependents |

| Tax Benefits | 80C deductions; tax-free payout (10(10D)) | Same, plus potential bonuses |

| Flexibility | Riders available | Limited; fixed lifelong |

With 0% GST in 2025, both are cheaper, but term offers better value for pure protection.

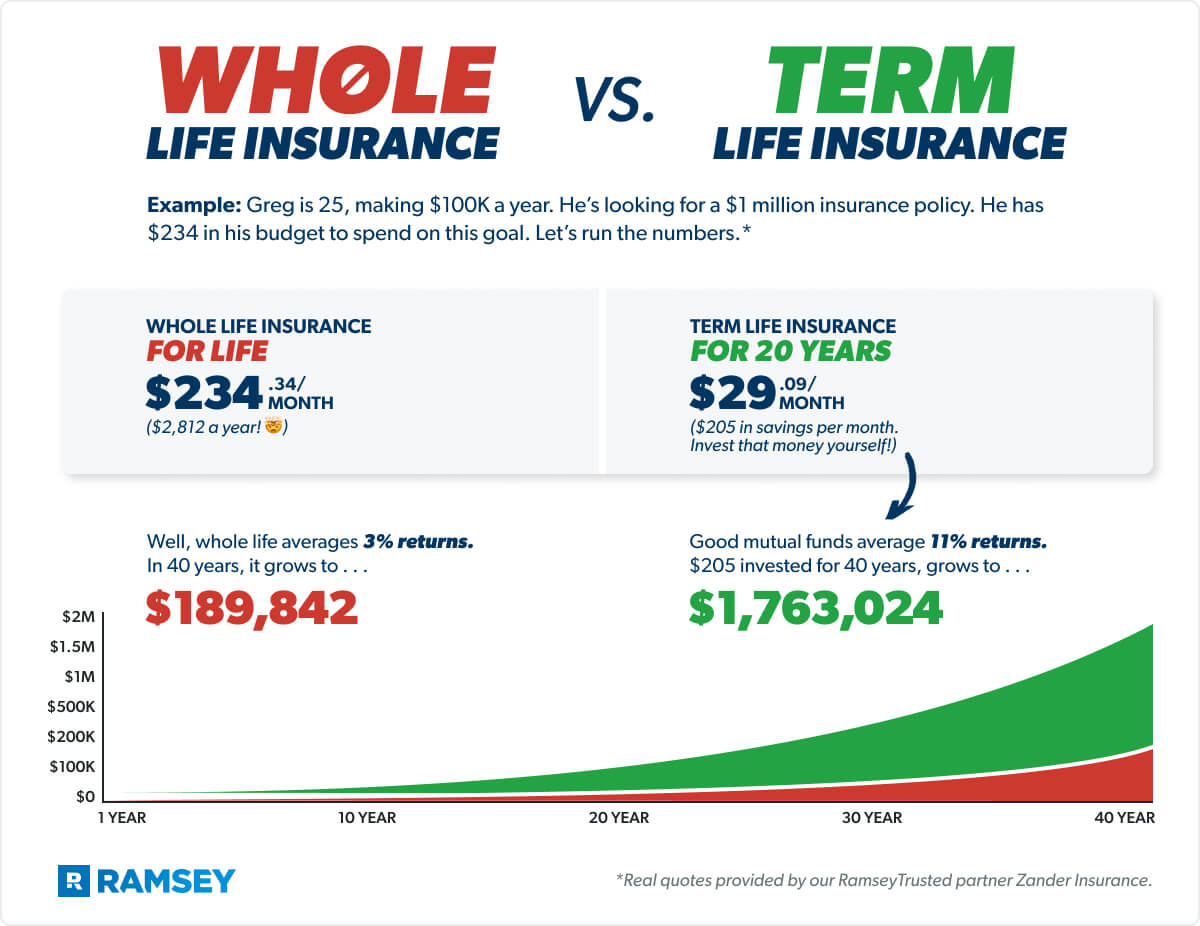

(Image: Comparison chart of term vs whole life insurance.)

Pros and Cons of Term Life Insurance

Pros:

- Affordable—high cover (₹1-2 crore) at low premiums.

- Pure protection focus.

- Flexible terms and riders (critical illness, accidental death).

- Recommended by experts for most Indians.

Cons:

- No payout if you outlive the term (unless ROP).

- Premiums increase on renewal.

Pros and Cons of Whole Life Insurance

Pros:

- Lifelong coverage—no renewal worries.

- Builds wealth (bonuses/cash value).

- Guaranteed payout for nominees.

Cons:

- Expensive—lower initial cover for same premium.

- Locked-in for life; lower liquidity.

(Image: Person comparing life insurance plans online.)

When to Choose Term Life Insurance

Choose term life insurance if:

- You're young with dependents/loans.

- Need high coverage affordably.

- Plan to invest separately (e.g., mutual funds for better returns).

- Most financial advisors recommend term + investments over whole life.

Top plans (2025): HDFC Life Click 2 Protect, ICICI Pru iProtect Smart, Axis Max Life Smart Term Plan Plus—high CSR (99%+).

When to Choose Whole Life Insurance

Opt for whole life insurance if:

- You want guaranteed lifelong cover.

- Have perpetual dependents (e.g., special needs child).

- Seek built-in savings/legacy.

Plans often from LIC (e.g., Jeevan Anand variants) or private insurers' whole life options.

Factors to Consider in 2025

- Age & Health: Buy early for lower premiums.

- Needs: Pure protection? Term. Savings + protection? Whole life (or separate investments).

- CSR: Aim for 99%+ (HDFC Life, Axis Max Life lead).

- 0% GST: Direct savings on premiums.

- Compare online on Policybazaar for quotes.

Many experts say term is "better" for 80-90% of people—cheaper, higher cover, invest difference separately.

Conclusion: Which Is Better?

For most Indians in 2025, term life insurance is better—offering maximum protection at minimal cost, amplified by 0% GST. Pair it with investments for wealth growth. Whole life insurance suits specific legacy/savings needs but is costlier.

Assess your goals, compare quotes online, and secure your family's future today. Peace of mind is priceless!

.jpg)

0 $type={blogger}:

Post a Comment