Best Travel Insurance Plans – Safe & Worry-Free Travel

Traveling opens up amazing experiences, but unexpected issues like medical emergencies, trip cancellations, lost baggage, or flight delays can disrupt your plans and finances. The best travel insurance plans provide comprehensive protection, ensuring safe & worry-free travel whether you're heading domestically or internationally.

As of December 2025, the full exemption of 18% GST on individual and family travel insurance premiums (effective September 22, 2025) has made coverage more affordable, with premiums often starting at ₹20-50 per day. This guide covers top plans, key features, and tips for hassle-free journeys.

(Suggested Featured Image: Family enjoying a safe vacation, protected by travel insurance.)

Why Travel Insurance Ensures Safe & Worry-Free Travel in 2025

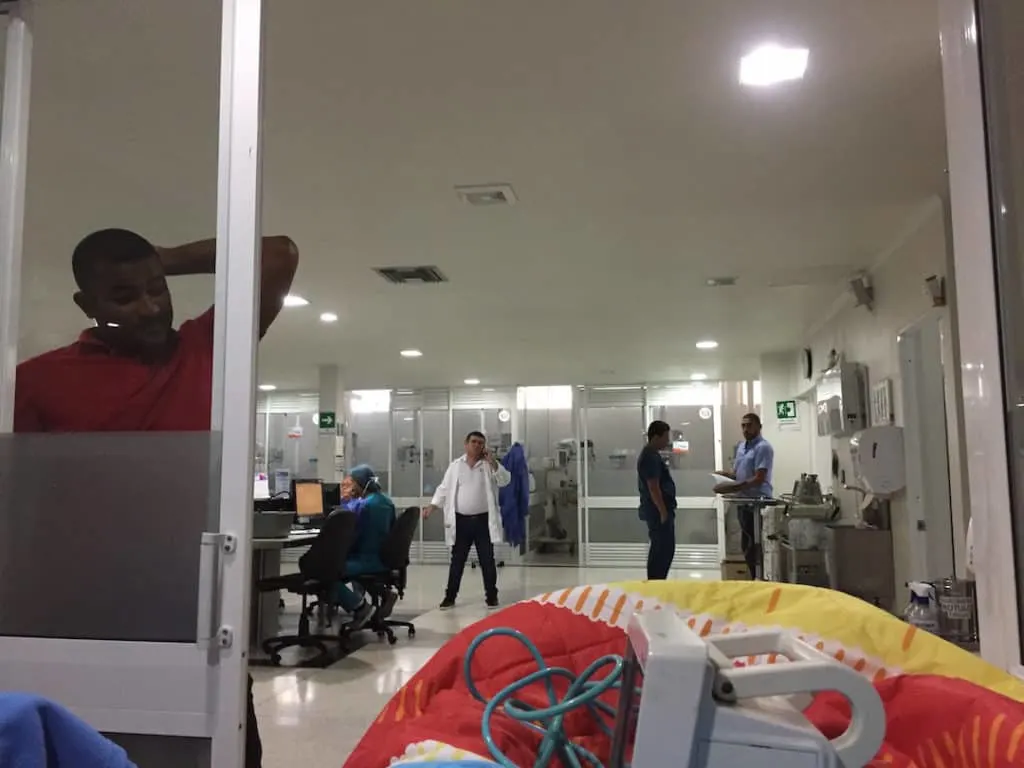

Global travel has rebounded, but risks persist: high medical costs abroad (₹20-50 lakhs+ for hospitalization), baggage mishaps, or disruptions from weather/geopolitical issues. Travel insurance covers medical expenses (up to $1 million), trip cancellations (reimbursement up to trip cost), baggage loss/delay, and 24/7 assistance.

It's mandatory for visas to Schengen countries (€30,000+ medical) and recommended everywhere. With 0% GST savings and high claim settlement ratios (95%+ from leaders), it's a small price for big protection.

(Image: Illustration of a medical emergency abroad being covered seamlessly.)

Key Benefits of the Best Travel Insurance Plans

Top plans offer:

- Medical Coverage — Hospitalization, evacuation, cashless treatment globally.

- Trip Protection — Cancellation, curtailment, delays.

- Baggage Support — Loss/delay compensation ($500-1,000+).

(Image: Lost baggage scenario at the airport, a common covered risk.)

- Personal Perils — Accident, liability, passport loss.

- Add-Ons — Adventure sports, pre-existing diseases (PEDs), COVID extensions.

Annual multi-trip plans suit frequent travelers.

How to Choose & Buy the Best Travel Insurance Online

Buying online is quick and rewarding:

- Compare Easily → Instant quotes from multiple insurers.

(Image: Traveler comparing plans online for the perfect fit.)

- Customization & Savings → Add-ons, discounts + 0% GST.

Steps:

- Assess trip details (duration, destination, travelers).

- Visit Policybazaar or insurer sites.

- Enter info for quotes.

- Compare coverage/CSR.

- Add riders.

- Pay & get e-policy.

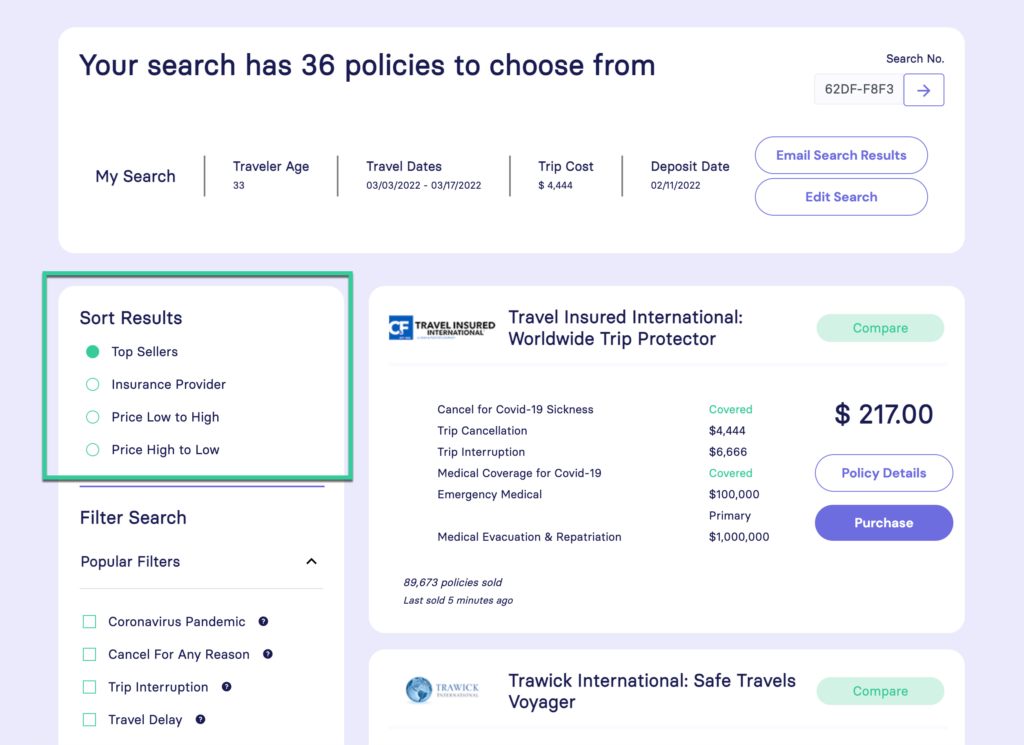

Top Best Travel Insurance Plans for Safe & Worry-Free Travel in 2025

Standout plans (high CSR, features):

- Tata AIG Travel Guard → Unlimited evacuation, multi-trip options.

- HDFC ERGO Travel Explore → PED/adventure cover, affordable.

- ICICI Lombard iTravel → ~98% CSR, global cashless.

- Bajaj Allianz Travel Elite → Family floater, hijack allowance.

- Niva Bupa TravelSafe → Student/senior focus.

- ACKO Travel → Budget-friendly, app claims.

(Image: Visual comparison of leading travel insurance plans.)

All visa-compliant; family plans popular.

Tips for Maximum Protection & Savings

- Buy early for cancellation cover.

- Opt family/multi-trip.

- Higher deductible for lower premiums.

- Disclose PEDs honestly.

- Leverage 0% GST.

- Check exclusions (war, intoxication).

Conclusion: Travel Safe & Worry-Free Today

The best travel insurance plans in 2025 ensure safe & worry-free travel with robust coverage at lower costs thanks to 0% GST. From Tata AIG's comprehensive guard to ACKO's simplicity, there's a perfect fit for every journey.

(Image: Happy family on a protected international trip.)

Compare on Policybazaar or insurer sites now—enjoy your adventures fully protected!

/AF_49-Chart-2d.png?width=800&height=582&name=AF_49-Chart-2d.png)