Best Life Insurance Plans – Secure Your Family’s Future

Your family's financial stability depends on smart planning, especially in uncertain times. Life insurance provides a safety net, ensuring your loved ones maintain their lifestyle, clear debts, fund education, and achieve goals even if you're no longer there. With rising costs and risks like lifestyle diseases, the best life insurance plans offer high coverage at affordable premiums.

As of December 2025, the full exemption of 18% GST on individual life insurance premiums (effective September 22, 2025) has made policies cheaper and more accessible. This comprehensive guide explores top plans, types, benefits, and tips to secure your family's future.

(Suggested Featured Image: Indian family protected under a life insurance shield, symbolizing security and peace of mind.)

Why Life Insurance is Essential for Your Family's Future in 2025

India faces increasing premature deaths from heart disease, cancer, and accidents. Without adequate coverage, families often exhaust savings or borrow heavily.

A strong life insurance policy delivers:

- Income replacement for daily needs.

- Debt clearance (home loans, etc.).

- Funding for children's education and marriage.

- Retirement support for spouse.

Additional perks include tax savings under Section 80C (up to ₹1.5 lakhs) and tax-free maturity/death benefits under 10(10D). Leading insurers boast claim settlement ratios (CSR) of 99%+, ensuring reliability. The 0% GST exemption directly lowers premiums, making higher coverage achievable.

(Image: Happy Indian family smiling, representing the emotional and financial security from life insurance.)

Types of Life Insurance Plans

Common options include:

- Term Insurance — Pure protection with high cover at low cost; ideal for most families.

- Endowment Plans — Protection plus savings/maturity benefit.

- ULIPs — Insurance + market-linked investments.

- Whole Life Plans — Coverage up to age 99-100 with cash value.

- Child Plans — Focused on education/goals.

Experts often recommend term for core protection, combined with separate investments for growth.

(Image: Comparison chart of life insurance plans in India.)

Benefits of Buying Life Insurance Online

Platforms like Policybazaar and insurer sites (HDFC Life, ICICI Pru, Axis Max Life) simplify the process:

- Instant Quotes & Comparison → From 20+ insurers.

- Savings → Online discounts + 0% GST.

- Convenience → Paperless, quick issuance.

- Customization → Easy riders (critical illness, accidental death).

Buy early to lock low premiums.

(Image: Person buying life insurance online on a laptop.)

Step-by-Step: How to Choose & Buy the Best Plan Online

- Calculate Needs — Aim for 15-25x annual income.

- Compare Quotes — Use aggregators.

- Evaluate CSR — >99%.

- Add Riders — For extra protection.

- Purchase — Instant policy.

Top Best Life Insurance Plans in India for 2025

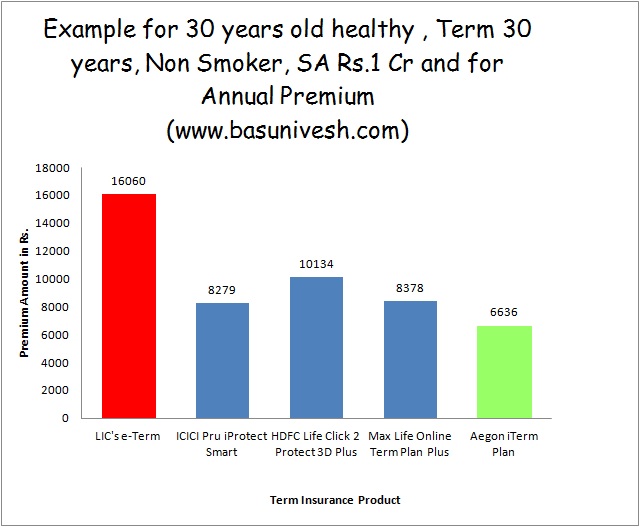

Focused on term plans (recommended for pure protection), based on CSR, features, and value:

- Axis Max Life Smart Term Plan Plus → ~99.70% CSR; flexible, high cover.

- HDFC Life Click 2 Protect → ~99.68% CSR; return of premium options.

- ICICI Pru iProtect Smart → ~99.3% CSR; comprehensive riders.

- Tata AIA Sampoorna Raksha → ~99.41% CSR; affordable.

- Max Life Online Term Plan → Strong features, competitive.

These offer ₹1 crore+ cover at low premiums post-GST exemption.

(Image: Illustration securing family future with life insurance.)

How to Save on Premiums & Maximize Benefits

- Buy Young → Lowest rates.

- Non-Smoker/Healthy → Discounts.

- Online Purchase → Exclusive deals + 0% GST.

- Higher Long-Term Cover → Value.

- Tax Advantages → Reduce net cost.

Common Mistakes to Avoid

- Insufficient cover.

- Delaying purchase.

- Hiding health details.

- Ignoring CSR/riders.

Conclusion: Act Now to Secure Your Family’s Future

The best life insurance plans in 2025—from Axis Max Life, HDFC Life, and ICICI Pru—deliver reliable protection with high CSR and affordability thanks to 0% GST. Prioritize term plans for maximum security.

Compare online today and take the step toward lasting peace of mind. Your family's future deserves it!

0 $type={blogger}:

Post a Comment