Traveling internationally opens up incredible experiences, but it also exposes you to risks like high medical bills abroad, flight disruptions, lost luggage, or unexpected trip cancellations. International travel insurance provides essential financial protection, covering emergencies that could otherwise cost lakhs or even crores. In India, a robust travel insurance policy is not just recommended—it's mandatory for visas to many countries like Schengen nations (requiring at least €30,000 medical cover).

As of December 2025, individual and family international travel insurance policies enjoy a complete 0% GST exemption (effective September 22, 2025), reducing premiums by up to 18% and making comprehensive coverage more accessible. This guide explains key coverage areas, benefits, costs, and how to choose the right plan.

(Suggested Featured Image: Family protected under an insurance shield while traveling with luggage and airplane elements.)

Why International Travel Insurance is Crucial in 2025

Medical treatment abroad is exorbitantly expensive—a hospital stay in the US or Europe can exceed ₹50 lakhs without insurance. Other common issues include baggage loss (reimbursed $500-1,000+), flight delays, or personal accidents.

International travel insurance typically includes:

- Emergency medical expenses and evacuation/repatriation (up to $1 million in top plans).

- Trip cancellation/interruption reimbursement.

- Baggage loss/delay and passport replacement.

- 24/7 global assistance.

With 0% GST, high claim settlement ratios (95%+ from leading insurers), and IRDAI-mandated features like COVID coverage, policies are more reliable and affordable. Many plans are visa-compliant for popular destinations.

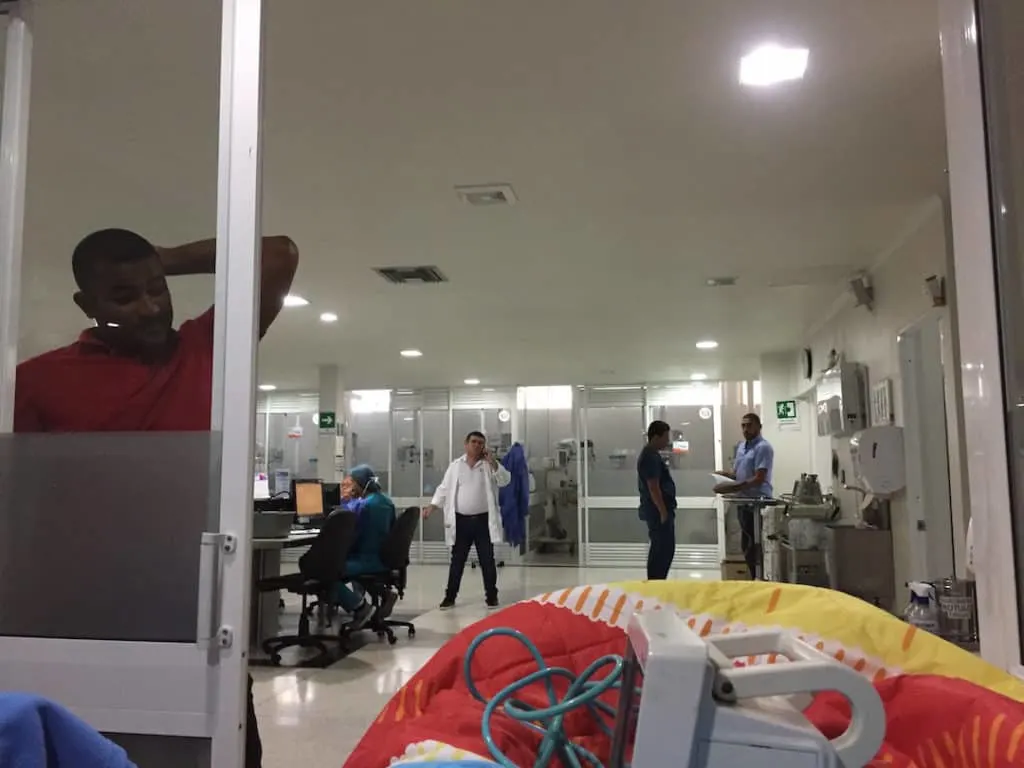

(Image: Medical emergency scene abroad, illustrating the high costs without insurance coverage.)

Key Coverage in International Travel Insurance Plans

Standard features in most policies:

- Medical Coverage: Hospitalization, outpatient treatment, evacuation (critical for remote areas).

- Trip-Related Risks: Cancellation (due to illness/death), curtailment, delays/missed connections.

- Baggage & Personal Effects: Loss, delay ($100-200/day), theft.

- Personal Accident & Liability: Death/disability benefits, third-party legal cover.

- Other Perks: Passport loss, hijack distress allowance, home burglary (in some plans).

Add-ons: Adventure sports, pre-existing disease (PED) waiver, senior-specific extensions.

(Image: Lost baggage at airport, a common claim under travel insurance.)

Benefits of International Travel Insurance

- Financial Security: Cashless treatment at 1 lakh+ global hospitals.

- Peace of Mind: 24/7 emergency helplines for claims/assistance.

- Visa Compliance: Meets requirements for Schengen, USA, etc.

- Custom Options: Family floaters, multi-trip for frequent flyers, student/senior plans.

- GST Savings: 0% tax means lower effective costs.

- Quick Claims: High CSR from insurers like ICICI Lombard (~98%).

Annual multi-trip plans save for business travelers.

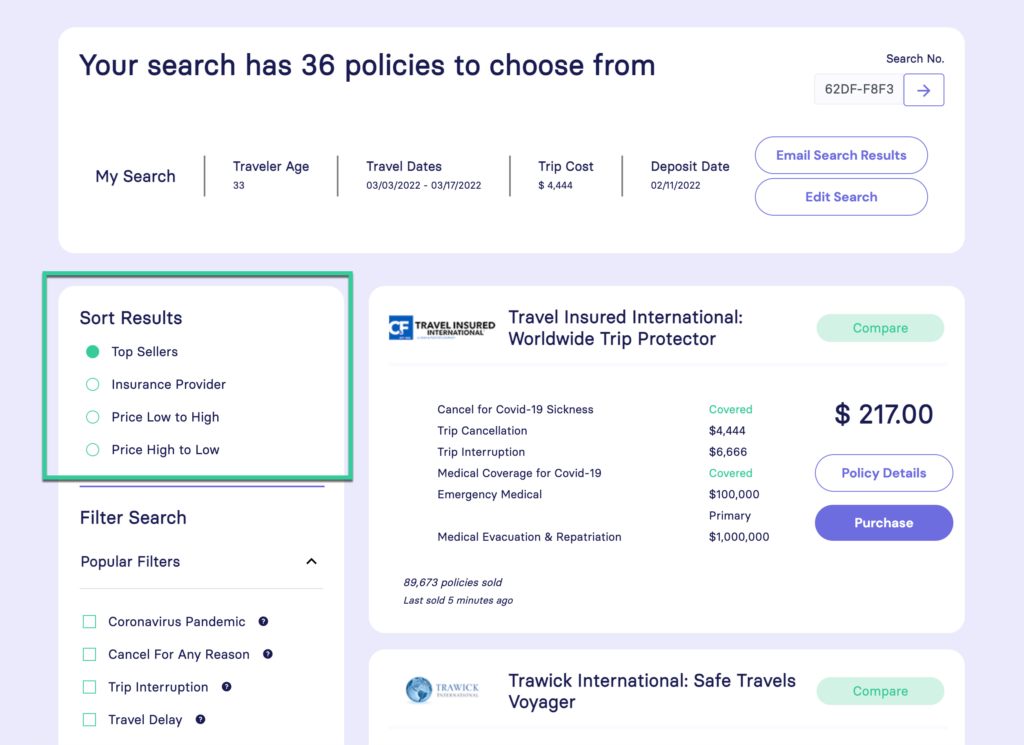

(Image: Person comparing international travel insurance plans online for the best fit.)

Cost of International Travel Insurance in 2025

Premiums are affordable post-GST exemption, starting ₹20-50 per day:

- Short trip (7-10 days, Asia): ₹300-900.

- Europe/USA (2 weeks): ₹800-2,500.

- Family plans: Often cheaper per person.

- Annual multi-trip: ₹5,000-15,000 for unlimited trips.

Factors affecting cost:

- Age (higher for seniors).

- Destination (USA/Europe pricier due to medical costs).

- Sum insured ($50,000-$1 million).

- Duration & add-ons.

Compare on Policybazaar or insurer sites for exact quotes—savings from 0% GST make higher coverage viable.

Top International Travel Insurance Plans in India for 2025

Leading options based on coverage, CSR, and value:

- Tata AIG Travel Guard: Unlimited evacuation, strong multi-trip, PED options.

- HDFC ERGO Travel Explore: Adventure add-ons, affordable seniors.

- ICICI Lombard iTravel: High CSR (~98%), cashless global network.

- Bajaj Allianz Travel Elite: Family floater, hijack benefit.

- Niva Bupa TravelSafe: Student/senior focus, quick claims.

- ACKO Travel: Budget-friendly (₹20/day+), app-based.

All meet visa needs; buy online for instant issuance.

(Image: Happy family enjoying a safe international vacation with travel insurance protection.)

Tips to Choose & Save on International Travel Insurance

- Buy early for cancellation cover.

- Opt family/multi-trip for savings.

- Higher deductible lowers premium.

- Disclose PEDs honestly.

- Compare CSRs and networks.

- Leverage 0% GST fully.

Avoid low sums for costly destinations.

Common Exclusions & Mistakes

Exclusions: War, intoxication, undisclosed PEDs.

Mistakes: Buying post-departure, ignoring add-ons, low medical limits.

Read policy wordings carefully.

Conclusion: Secure Your International Journey Today

International travel insurance is indispensable for worry-free global adventures, offering extensive coverage, invaluable benefits, and affordable costs in 2025—enhanced by 0% GST. Whether solo, family, or business, plans from Tata AIG, HDFC ERGO, and others provide robust protection.

Compare quotes online now and travel confidently—your safety net is just a click away!

0 $type={blogger}:

Post a Comment