Car ownership in India brings convenience but also exposes you to risks like accidents, theft, natural calamities, and third-party liabilities. Repair costs have risen sharply due to advanced technology and inflation, often reaching ₹50,000-₹2 lakhs for moderate damage. Car insurance provides essential financial protection, and understanding its workings helps you choose wisely.

In 2026, online platforms make it easier than ever to compare plans, get instant quotes, and buy policies digitally. Leading insurers like ACKO, Go Digit, HDFC ERGO, Tata AIG, and Bajaj Allianz offer high claim settlement ratios (often 95-99%), extensive cashless networks, and valuable add-ons. This guide breaks down coverage types, benefits, and steps to secure the best quotes online.

(Suggested Featured Image: Family researching car insurance online, symbolizing informed digital decisions.)

Why Car Insurance is Mandatory and Beneficial in 2026

The Motor Vehicles Act, 1988, mandates at least third-party (TP) liability coverage, with fines up to ₹2,000 for first offense and ₹4,000 for repeats. TP protects against damages or injuries you cause to others.

Comprehensive policies extend to your own vehicle. With India's high accident rates (over 1.5 lakh fatalities annually) and rising thefts/floods, insurance prevents financial devastation. Top insurers provide 5,000-11,000+ cashless garages for seamless repairs.

(Image: Car accident damage, highlighting the need for own-damage coverage.)

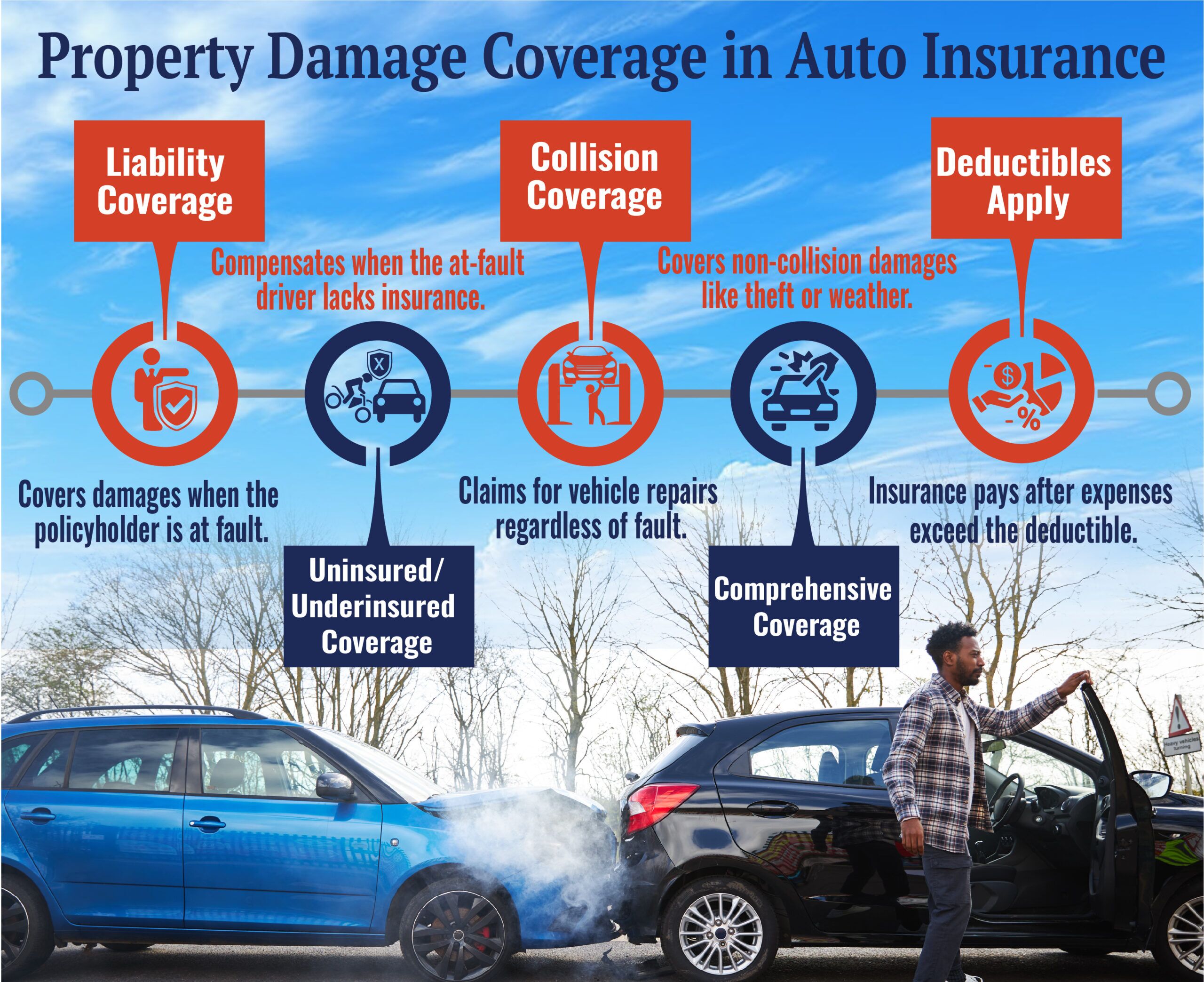

Types of Car Insurance Coverage

India offers three main types:

- Third-Party (TP) Only → Mandatory; covers third-party death/injury (unlimited in some cases) and property damage (up to ₹7.5 lakhs). Cheapest but no protection for your car.

- Standalone Own-Damage (OD) → Covers your vehicle's damage/theft; add to existing TP.

- Comprehensive → TP + OD; includes accidents, fire, theft, natural/man-made disasters.

Comprehensive is most popular, especially with add-ons for full protection.

(Image: Car insurance policy document and premium calculator, essential for understanding costs.)

Key Benefits of Car Insurance

- Financial Protection — Covers repairs/replacement, avoiding out-of-pocket expenses.

- Peace of Mind — Cashless claims at network garages.

- No Claim Bonus (NCB) — Up to 50% discount for claim-free years.

- Personal Accident Cover — Mandatory ₹15 lakhs for owner-driver.

- Add-On Enhancements — Tailored protection (e.g., zero dep).

High CSR (e.g., ACKO ~99%, Go Digit ~96%) ensures reliable payouts.

(Image: Protected car with insurance shield, representing security.)

How to Get the Best Quotes Online

Online buying saves time and money:

- Instant Quotes → Personalized based on car details.

- Comparison Tools → Evaluate 20+ insurers.

- Savings → No agent fees; exclusive discounts.

- Paperless → Quick issuance.

Steps:

- Visit Policybazaar, ACKO, or insurer sites.

- Enter car registration, make/model, RTO.

- Provide previous policy for NCB.

- Compare quotes, CSR, garages.

- Add customizations.

- Pay and download e-policy.

Digital insurers like ACKO/Go Digit excel in app-based processes.

(Image: Happy family with insured car, enjoying worry-free drives.)

Popular Add-Ons for Enhanced Coverage in 2026

Standard policies have gaps—add-ons fill them:

- Zero Depreciation — No deduction for parts wear.

- Roadside Assistance — Towing, fuel, flat tire help.

- Engine/Gearbox Protection — Covers costly repairs.

- Return to Invoice (RTI) — Full original price on total loss.

- NCB Protector — Retains bonus after claim.

- Consumables Cover — Oils, nuts, etc.

These are crucial for urban drivers or expensive cars.

Tips to Get the Best Quotes & Save on Premiums

- Compare Widely → Different platforms show varying deals.

- Claim NCB → Transfer for up to 50% off.

- Install Anti-Theft → ARAI-approved for discounts.

- Higher Deductible → Voluntary excess lowers premium.

- Long-Term Policy → 2-3 years for stability.

- Accurate IDV → Balances premium and claim.

- Bundle → With home/health for multi-policy discounts.

Savings can be 30-50% with smart choices.

Common Mistakes to Avoid

- Choosing only TP for new/expensive cars.

- Understating IDV for lower premium (reduced claims).

- Forgetting renewal (lose NCB, lapse coverage).

- Not disclosing modifications/usage.

- Ignoring CSR/garage network.

Conclusion: Drive Protected with the Best Coverage

Car insurance is your shield on the road—explaining coverage options, benefits, and online quoting empowers better decisions. In 2026, top players like ACKO, Go Digit, HDFC ERGO, and Tata AIG deliver reliable protection with innovative features.

Get quotes online today—compare, customize, and save for worry-free driving!

:max_bytes(150000):strip_icc()/INV_AutoInsuranceQuote_GettyImages-1434074156-81186deb034742af8fc27d668599b0a1.jpg)

0 $type={blogger}:

Post a Comment