Travel insurance protects against unexpected events that disrupt trips or cause financial loss. Whether traveling domestically or internationally, a good policy covers medical emergencies, trip cancellations, lost baggage, and more—turning potential disasters into manageable issues.

As of January 2026, individual and family travel insurance policies benefit from 0% GST (exempt since September 22, 2025), making them more affordable. Premiums often start at ₹20-50 per day, with high claim settlement ratios (95%+) from top insurers.

(Suggested Featured Image: Family researching and buying travel insurance online.)

Why Travel Insurance is Essential

Medical treatment abroad can cost ₹20-50 lakhs or more for serious issues. Other risks include flight delays, baggage loss, or cancellations due to illness/weather.

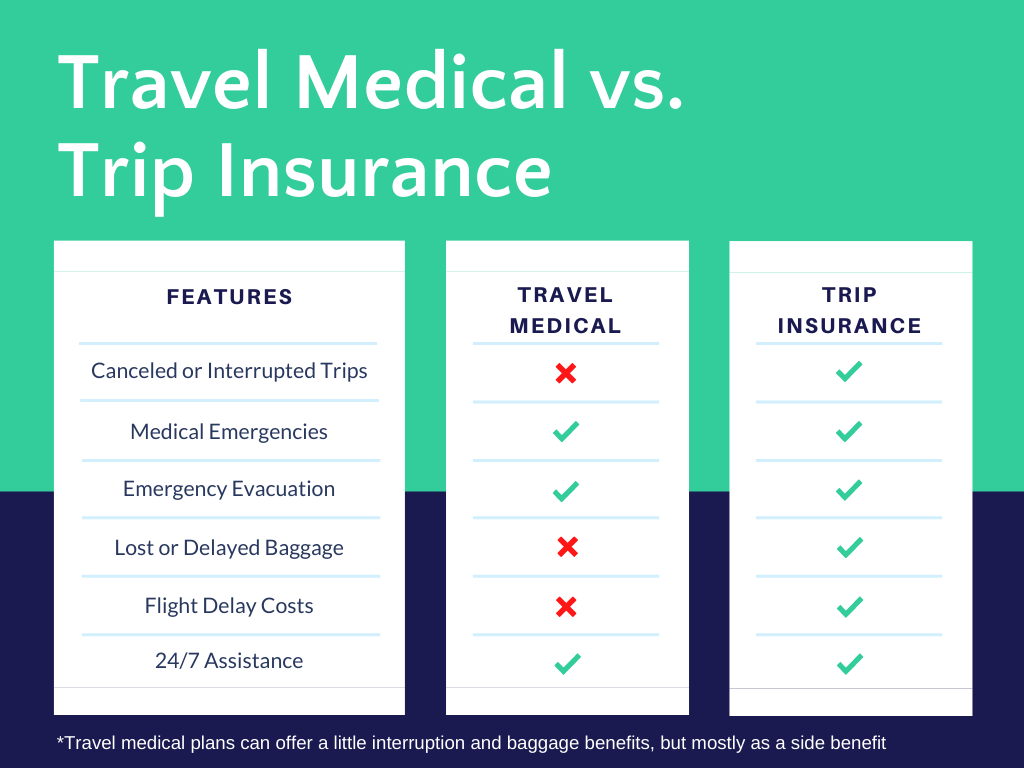

Key protections:

- Emergency medical expenses and evacuation (up to $1 million).

- Trip cancellation/interruption reimbursement.

- Baggage loss/delay ($500-1,000+).

- 24/7 global assistance.

Many visas (e.g., Schengen requires €30,000+ medical) mandate it. With 0% GST, coverage is budget-friendly.

(Image: Medical emergency abroad scenario.)

Main Coverage Areas

Standard policies include:

- Medical Emergencies — Hospitalization, outpatient care, evacuation/repatriation.

- Trip Cancellation/Curtailment — Reimbursement for non-refundable costs due to covered reasons.

- Baggage Loss/Delay — Compensation for lost items or essentials during delays.

(Image: Lost baggage at airport.)

- Flight Delays/Missed Connections — Allowances for meals/hotels.

- Personal Accident/Liability — Death/disability benefits; third-party claims.

- Passport Loss — Assistance and reimbursement.

Add-ons: Adventure sports, pre-existing diseases (PEDs), COVID extensions.

Single-trip for one journey; annual multi-trip for frequent travelers.

Key Benefits

- Financial Safeguard → Cashless treatment at global networks.

- Peace of Mind → 24/7 helplines.

- Visa Compliance → Meets requirements for many countries.

- Customization → Family/student/senior plans.

- GST Savings → 0% tax on individual policies.

- Quick Claims → High CSR insurers.

Common Mistakes to Avoid

Many travelers undermine coverage:

- Buying Too Late — Purchase early for cancellation protection; post-departure limits benefits.

- Choosing Cheapest Policy — Low premiums often mean inadequate medical limits or exclusions.

- Not Disclosing PEDs — Leads to claim rejection.

- Underestimating Medical Sum — Opt $100K+ for high-cost destinations.

- Ignoring Exclusions — War, intoxication, extreme sports without add-on.

- Assuming Credit Card Covers Enough — Limits are often low.

- Not Reading Fine Print — Miss sub-limits or conditions.

- Forgetting Add-Ons — For adventure or valuables.

Buy soon after booking; disclose honestly; compare CSR/networks.

Conclusion: Travel Protected

Travel insurance covers essentials like medical/trip/baggage risks, offering benefits from cashless care to reimbursement. Avoid mistakes like late purchase or non-disclosure for full protection.

In 2026, with 0% GST and strong plans from Tata AIG, HDFC ERGO, ICICI Lombard, and ACKO, it's easier to travel worry-free.

(Image: Happy family traveling safely.)

Compare on Policybazaar or insurer sites—enjoy your trips fully insured!

0 $type={blogger}:

Post a Comment